Facts from the Week: March 6, 2022

Highlights from $COST $BKE $TJX $RCII $RUTH $BIG $PBPB $EXPD $HD $LOW $RDFN $FMCC $TOL $TPX $FND

Consumer

Costco - $COST

a quarter ago, I mentioned that we estimated, at that time, overall price inflation to have been in the 4.5% to 5% range. For the second quarter and talking with senior merchants, estimated overall price inflation was in the 6% range.

Our comp traffic and frequency for February was up 8% worldwide and 8.2% in the United States.

The Buckle - $BKE

TJ Maxx - $TJX

As for the first quarter, we are planning U.S. comp store sales to be up 1% to 3% over an outsized 17% U.S. open-only comp store sales increase last year. For the start of the first quarter, we are very pleased that our U.S. comp sales growth is strong as we are seeing excellent consumer demand for both our apparel and home categories.

Rent a Center - $RCII

“In the fourth quarter, the combined effect of significantly reduced government pandemic relief, decades-high rates of inflation, and supply chain disruptions impacted our target customers’ ability to access and afford durable goods, which negatively impacted our results. We anticipate these external headwinds will continue for the foreseeable future, resulting in year-over-year declines in revenue and earnings for 2022, on a pro forma basis, while free cash flow should increase for the year," -CEO

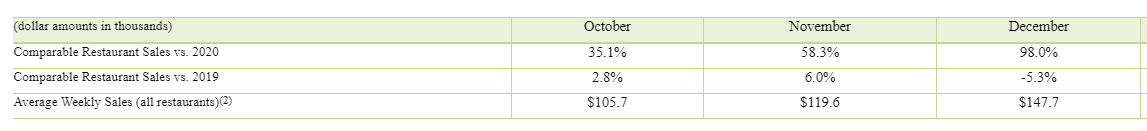

Ruth’s Chris - $RUTH

Quarter to date through February 20, 2022, Company-owned comparable restaurant sales increased 4.3% compared to 2019.

Big Lots - $BIG

clearly, in California, there's a major crime epidemic going on, enforcement of penalties or shoplifting have been largely kind of abandoned there. And certainly, you've heard of other retailers essentially even closing stores because they can't operate them viably. So we saw California spike pretty significantly. And relative to what we were seeing as late as June or July and our last round of physical inventories, there was a significant step up there.

Potbelly - $PBPB

Supply Chain

Expeditors - $EXPD

“Roughly two years of pandemic-induced disruption have led to unprecedented conditions throughout our industry, with little relief in sight. There is still too little international air capacity, as travellers have been kept from flying abroad; the ocean ports are too congested to accommodate many of the ships that need to load and unload their containers; and worker shortages are severely limiting overland capacity to support the freight that is able to arrive in port.

“We have worked our strong carrier relationships to secure as much capacity as we could get on behalf of all of the shippers looking for space during the quarter, but the severe imbalance between capacity and demand continues to heavily impact our industry. There is simply not enough carrier capacity in the air or on the oceans to accommodate the heavy demand for cargo space, particularly from China to the U.S., where historically high average buy and sell rates have been the most elevated.

“Despite the lack of space, we experienced record-high air tonnage in the fourth quarter, as we used more air charters than at any other time in our company’s history, even with extremely elevated rates. Ocean container volumes, by contrast, declined during the quarter, as we were somewhat limited in our ability to secure necessary capacity from ocean carriers, and hampered by the time and resources required to process shipments and meet sharply growing customer demand. -CEO

The Harpex - Harper Petersen

Housing

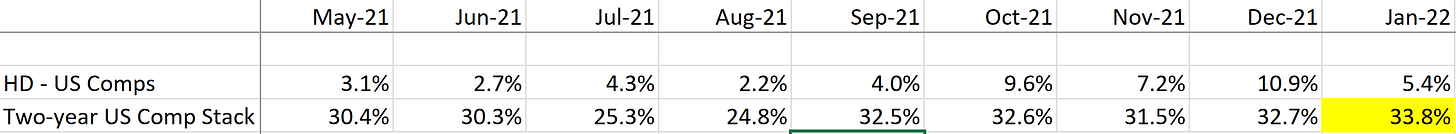

Home Depot - $HD

Now I'll comment on our outlook for 2022. The broader housing environment continues to be supportive of home improvement. Demand for homes continues to be strong, and existing home inventory available for sale remains near record lows, resulting in support for continued home price appreciation. On average, homeowners' balance sheets continue to strengthen as the aggregate value of U.S. home equity grew approximately 35% or $6.5 trillion since the first quarter of 2019. The housing stock continues to age, and customers tell us the demand for home improvement projects of all sizes is healthy.

Lowes - $LOW

Redfin - $RDFN

Home prices spiked to an all-time high of $363,975 as the market continued to heat up during the four-week period ending February 27. The median home-sale price was up 16% year over year, the biggest annual gain since August, and the typical home sold for 0.8% above list price, the largest premium since October. Intense competition among buyers driven by an extreme shortage of homes for sale is driving prices up unseasonably fast.

Mortgage Rates - Freddie Mac $FMCC

Toll Brothers - $TOL

Turning back to the demand side of the equation. The housing market and demand for our homes in particular is being propelled by strong demographics from both the millennial and boomer generations; a substantial imbalance between the tight supply of homes and continued pent-up demand; the wealth effect of rising existing home equity; migration trends and the greater appreciation for home. We believe these long-term tailwinds will continue to support demand for our homes well into the future.

We continue to see people move from states where home values, taxes and cost of living are higher to less expensive regions. This dynamic is spurring demand in markets across the country and particularly in the Sunbelt and Mountain states, where we have expanded in recent years. For these buyers, affordability is less of an issue.

We have also not seen an impact on demand from the recent increase in mortgage rates. I remind you that our customers are generally better insulated from affordability concerns compared to buyers in the entry-level market. Our buyers tend to have higher incomes and they benefited from multiple years of appreciation in their investment portfolios and their existing homes.

Also keep in mind that rates have no impact on monthly payments for about 15% to 20% of our customers, who pay all cash, and that another approximately 30% of our buyers borrow at jumbo rates, which are currently 0.625 point lower than conforming for our clients. And overall, our customers average less than 70% loan to value in their mortgages.

Q: And then I know you haven't seen any impact on demand yet, but have any of those warning sign metrics started to weaken for you at all?

A: Very good question. The warning signs are web traffic, foot traffic. And right now, web traffic and foot traffic is up significantly.

Tempur Pedic - $TPX

In the first quarter, we have seen softness from the lower end consumer, which we believe is temporary. We believe we are maintaining labor and advertising expenses that would otherwise naturally flex with sales.

If you look at our Tempur flagship stores, they started off the first quarter solid. And then when you move into Presidents' Day, I would call it strong with same-store sales so far in Presidents' Day running over 20%. If you look at entry-level bedding, lower end customer, that's been a challenge probably beginning in the fourth quarter. We continued into the first quarter.

Floor N Decor - $FND

From a macroeconomic perspective, we are planning on 2022 to be a good year. The secular demand in housing continues to exceed available supply, which has led to an acceleration in home price appreciation. We believe these factors, combined with record levels of homeowner equity and aging housing stock should further support home remodeling spending. In addition, we serve a higher-income consumer, and they have substantially higher wealth and home equity relative to pre-pandemic levels and there continues to be innovation in our category. With that said, we are monitoring factors such as today's Russian invasion of Ukraine and other geopolitical events, rising interest in mortgage rates, modest decline in existing home sales, inflationary pressures impacting the consumer and uncertainties related to the pandemic.

We are planning on our comparable store sales growth of 10.5% to 13% driven by our business model, a good macroeconomic backdrop and raising retail prices throughout 2022 to offset the anticipated higher supply chain and vendor product costs, which is remarkable considering the [average] comp growth we had in fiscal 2021 as well as the second half of 2020.

Odds and Ends

Gas Prices

Energy spending as % of income

AAII Bull Bear

CNN Fear Greed

US Federal Reserve Balance Sheet