Facts from the Week: Nov 7, 2021

Highlights from $COST $JPM $SKT $BKE $BGFV $RL $TCS $SMG $SII $IBKR $IEP $KKR $ABNB $KMB Consumer, Housing, Financials

Summary

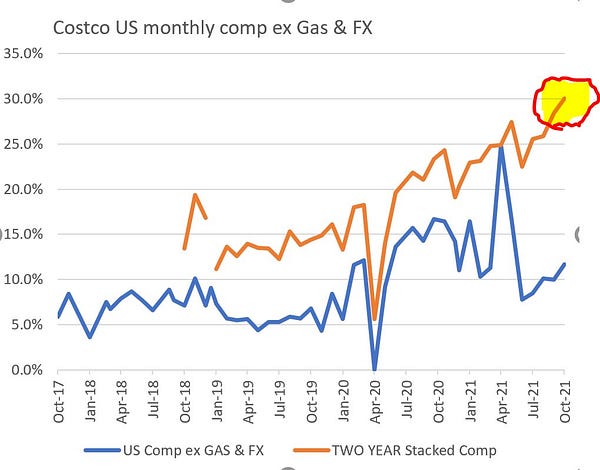

Consumer spending remains strong with Costco’s two-year comp in the US (ex gas/fx) up 30% and JP Morgan’s consumer spending tracker trending up

Financial markets are active with Interactive Brokers reporting an increase in Net New Accounts in October while KKR reported a significant increase in AUM

Consumer

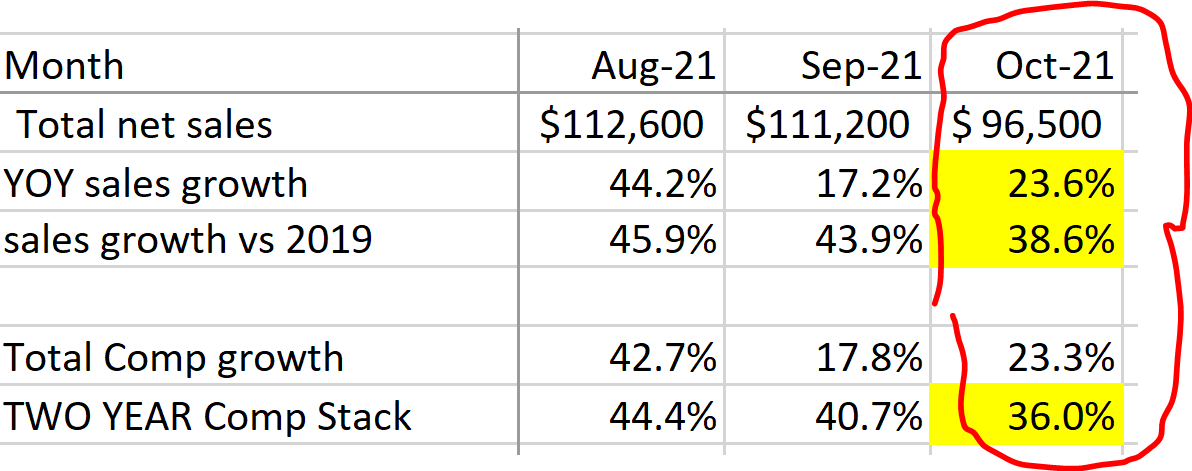

Costco- $COST - Results for October

October US comp ex gas/fx up 11.7%, two-year up 30.0%

JP Morgan - $JPM - Consumer spending tracker

Tanger Factory Outlet - $SKT

Tenant sales at our open-air centers are accelerating, reaching an all-time high of $448 per square foot for the consolidated portfolio during the twelve months ended September 30, 2021, an increase of more than 13% over the comparable 2019 period. Traffic has remained strong, representing approximately 99% of third quarter 2019 levels.

The Buckle - $BKE - October sales results

Ralph Lauren - $RL

In North America wholesale, revenues increased to 23% to last year. This was ahead of our expectations as the foundational work we completed through COVID to reset our inventories, elevate our product mix, exit lower-tier wholesale doors and significantly reduced off-price penetration is delivering improved top line growth and quality of sales.

Big Five - $BGFV

Same store sales for the third quarter of fiscal 2021 decreased 0.7% compared to the prior year period and increased 13.2% compared to the third quarter of 2019.

“We are pleased to report another strong quarter of sales and earnings. Despite a significant impact from the California wildfires, same store sales largely kept pace with last year’s peak pandemic-related sales surge, while comping very positively against 2019. While earnings were slightly down on a year-over-year basis primarily due to fiscal calendar shifts, sales were strong across our product mix, especially compared to pre-pandemic levels. We were particularly excited to see a resurgence in our team sports business as leagues and schools throughout our markets returned to more normal activities.” -CEO

For the 13-week fiscal 2021 fourth quarter, the Company expects same store sales to be in the range of negative low-single digits to positive low-single digits with earnings per diluted share in the range of $0.55 to $0.70. This compares to a same store sales increase of 10.5% and earnings per diluted share of $0.95 in the 14-week fourth quarter of fiscal 2020, which included a previously reported net benefit of $0.12 per diluted share. The mid-point of the Company’s guidance range reflects an expected same-store sales increase of approximately 10% versus the fiscal 2019 fourth quarter. The Company’s sales and earnings guidance for the fiscal 2021 fourth quarter assumes that any new conditions relating to the COVID-19 pandemic, including any regulations that may be issued in response to the pandemic, will not materially impact the Company’s operations during the period.

Housing

The Container Store - $TCS

Consolidated net sales were $276.0 million, an increase of 11.2% compared to the thirteen weeks ended September 26, 2020. Compared to second quarter fiscal 2019, consolidated net sales increased 16.7%.

Net sales in The Container Store retail business (TCS) were $259.4 million, up 11.3% compared to the second quarter of fiscal 2020, inclusive of a 22.1% increase in Custom Closets and a 3.1% increase in other product categories. Compared to the second quarter of fiscal 2019, TCS net sales were up 17.2%, inclusive of a 21.7% increase in Custom Closets and a 13.5% increase in other product categories.

The Company currently expects third quarter of fiscal 2021 consolidated sales decline of approximately 5% as compared to the third quarter of fiscal 2020.

Scotts Miracle Gro - $SMG

U.S. Consumer segment sales decline 28% in Q4

Hawthorne sales decline 2% in Q4 despite growth in the U.S.

Fiscal 2022 guidance: sales growth 0 to 3%

Financials

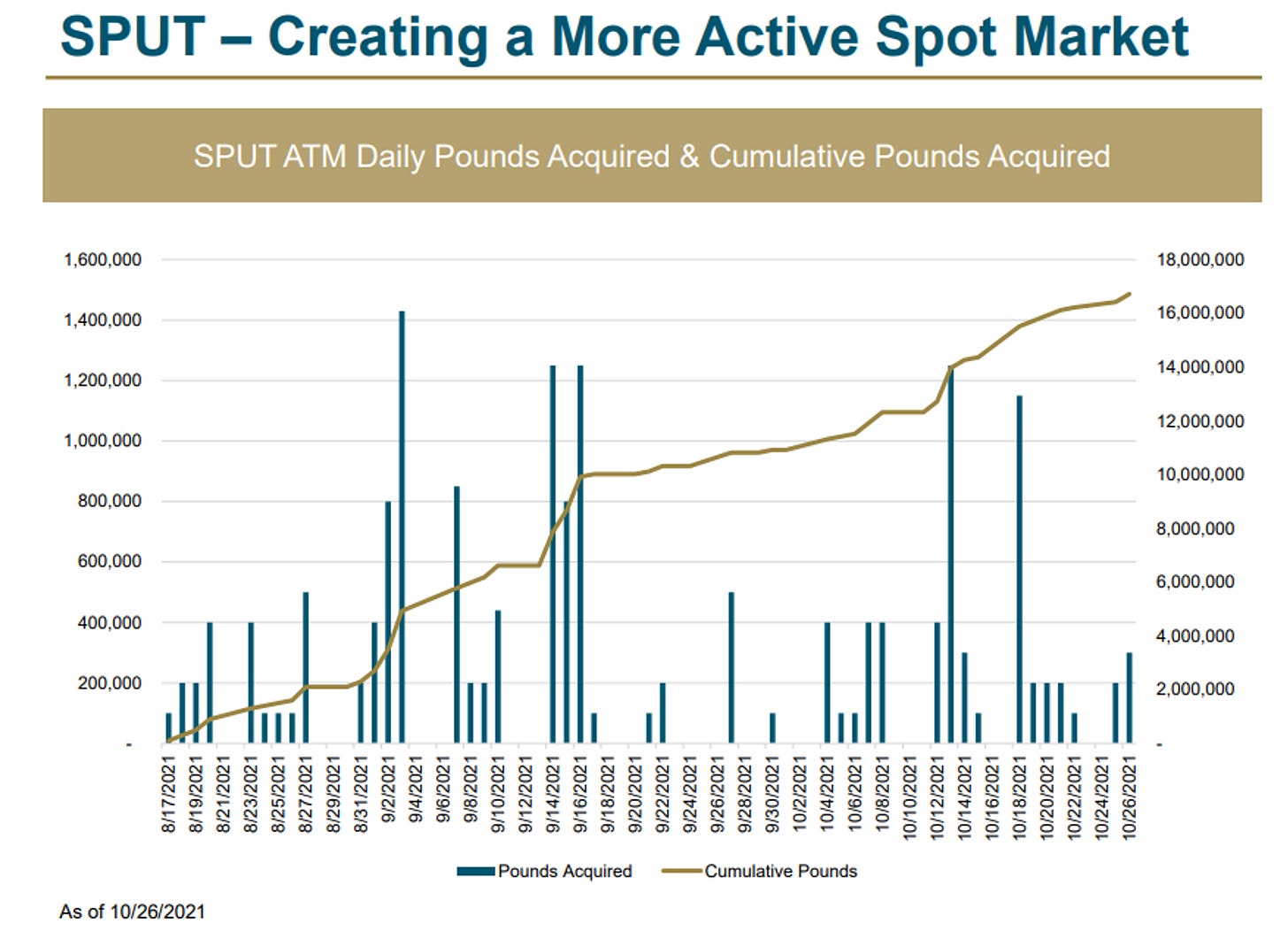

Sprott - $SII

On July 19, when we acquired UPC and reorganized the company to the new trust, the net asset value in the fund was $630 million. Fast forward to October 31, we're at $1.6 billion.

Interactive Brokers - $IBKR - October Results

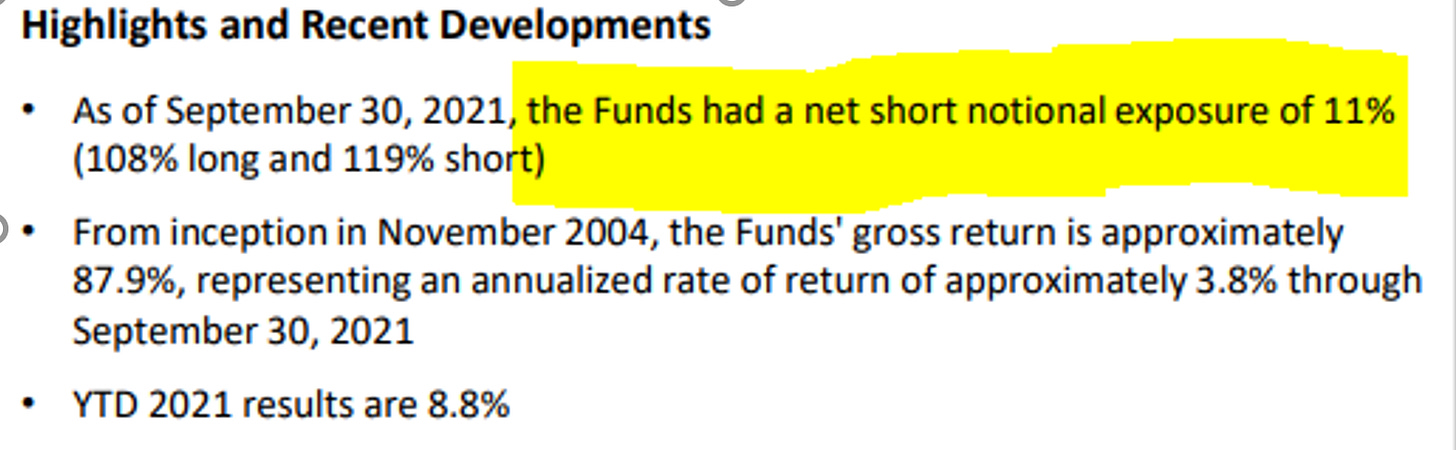

Icahn Enterprises - $IEP

KKR - $KKR

Odds and Ends

AirBNB - $ABNB

People are living on Airbnb. The increased popularity of long-term stays are turning traveling into living. Long-term stays of 28 days or more remained our fastest-growing category by trip length and accounted for 20% of gross nights booked in Q3 2021, up from 14% in Q3 2019. Long-term stays represent a broad set of use cases—including extended leisure travel, relocation, temporary housing, student housing, and many others. Our Hosts welcome this growing demand for long-term stays. More than 90% of active listings now accept long-term stays, and the number of active listings that offer the monthly discount is up 20% from Q3 2019.

Kimberley Clark - $KMB

We're paying higher rates for transportation. It's rolling through. In some cases, our employee tenure has shortened dramatically, and so it's changing how we staff because we have to staff more people to get the product out the door. We've got production outages, missed deliveries, and that ripples through with fines and everything else with customers.

Sprott: Earlier this year, the Congressional Budget Office (“CBO”) in the US published its long-term budget, which hinges on running major deficits until 2029, while interest rates are held well below the forecast rate of inflation throughout. We believe that these inflation trends will prove not to be transitory and that the CBO blueprint has now become the base case for the Federal Reserve, regardless of their tapering plans. The importance of this to Sprott is that as fixed income becomes less attractive, more investors are seeking non-correlated, inflation-protected alternatives to traditional financial assets.

Federal Reserve Balance Sheet

NYC Marathon today - always a great day in NYC

Thanks for reading and have a nice Sunday!

rationalresearch@substack.com

@RationalResear