Nordstrom - $JWN

Recent change to management incentive comp, cost cuts, trough multiple on low expectations, upcoming analyst day, insider ownership, and improving trends make for an interesting risk/reward set-up

Summary:

The JWN management team reset their incentive compensation to lever themselves much more to equity upside, with new options with an exercise price set two days after the recent August 25, 2020 earnings call incentivizing a “kitchen sink” quarter. Exercise price is $14.79 (above current share price).

Upcoming results should look better, with the Anniversary sale shifting from 2Q to 3Q and substantial cost cuts providing earnings upside ($500m of cost cuts compared to an EBITDA estimate of $1,080m in 2021)

On 9/10/20 JWN CEO noted: “we had, by quite a bit, the highest sell-through of anniversary merchandising we've ever had.” Macy’s, Capri, RH, Crocs, and others are also pointing to improving recent trends.

A large number of JWN competitors are closing stores which is a long-term benefit

Trough multiple on low expectations plus a 26% short interest

Nordstrom family owns ~31% of the equity and proposed taking the company private in March 2018 at $50 per share and again proposed taking their stake over 50% in October 2019 when the stock was in the mid-low $30s

Upside potential from a COVID vaccine and people feeling comfortable shopping again and want to update their wardrobe as there are more occasions to go out. Nordstrom is an “epicenter” stock.

Overview

On August 18th, 2020 JWN management changed their incentive comp plan to significantly increase their leverage to the equity upside. They did this by cancelling their Performance Share Unit grants and granting themselves stock options with an exercise price set on August 27, 2020, which was two days after the 2Q20 earnings release, with an exercise price of $14.79. (LINK to SEC filing)

This gave management an incentive to “kitchen sink” 2Q20 results in order to get the lowest exercise price on their options grated two days after the release. So it is worth considering whether 2Q20 will be the low point in JWN results, and one way management ensures 3Q results will look better is by moving the anniversary sale from 2Q20 to 3Q20 (the Anniversary sale typically happens in July but will happen in August this year).

Management noted on the 2Q20 earnings call that:

Net sales decreased 53 percent from last year, reflecting temporary store closures for approximately 50 percent of days during the quarter due to COVID-19 in addition to an approximately 10-percentage point timing impact from the Nordstrom Anniversary Sale shifting from the second quarter to the third quarter.

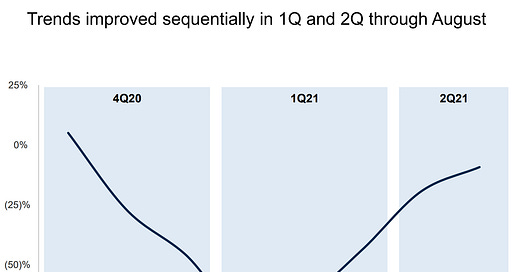

By my math, this implies about $345m of revenue shifting from 2Q to 3Q. The current revenue estimate for 3Q19 is $3,210 (down 12.7% yoy) which will get a $345m benefit from the anniversary sale shifting in to 3Q, so backing out the $345m benefit would imply the core business is down 22% yoy which is hopefully a low bar while management noted a sequential improvement in sales trends in August - from 8/25/20 earnings call:

We increased receipts in July as we geared up for our Anniversary Sale that began on August 4. This is our largest event, offering new arrivals at limited time savings. We're in the final week of the event, and results are in line with our expectations, reflecting a notable sequential improvement in full price sales trends.

Subsequently management stated at their 9/10/20 presentation at the GS conference:

“A proof point to that, we had, by quite a bit, the highest sell-through of anniversary merchandising we've ever had.”

This implies margins should be relatively good, inventory clean, and JWN should be well positioned to chase trends in the back half of the year. At the same conference, Capri (significant vendor to JWN with Michael Kors, Jimi Choo, and Versache) noted improving sales trends through August especially in North America). “North America is the best -- next best business for us. Business is healing here quite quickly, and again, much faster than we had anticipated. And we like what we're seeing happen.” - Capri CEO. From CPRI presentation 9/10/20:

And as Nordstrom management noted in the 10Q filed 9/4/20: “Based on current trends and our inventory plans, we expect sequential and gradual improvement in sales, earnings and cash flow in the back half of the year.”

Prior to COVID, sales had been growing (4Q19 sales were up 1.3% and February was “ahead of plan”) so expectations for -22% core sales in 3Q20 and -11% for 4Q20 are well below pre-COVID trends. Initial guidance from 3/3/20 had been for 1.5% to 2.5% sales growth in 2020 (more detail below).

As we discussed last quarter, we finished 2019 in a strong financial position, accelerated sales trends in the second half and demonstrated our inventory and expense discipline. This momentum continued into February, with sales tracking ahead of our guidance expectations for the month. -CFO 5/28/20

Cost Cuts: Management has made meaningful cost cuts reducing overhead costs by 20%, and is expecting $500m of permanent cash cuts in 2020 ($420m of which have already been completed). This is substantial when compared to the EBITDA estimate in 2021 of $1,080m

In addition to planned expense savings of $200 million to $250 million at the beginning of the year, we're continuing to execute cash savings across expense, CapEx and working capital of more than $500 million net of COVID-19-related expenses. Tracking ahead of our plans, we realized $420 million in cash savings year-to-date.

These cost cuts are already showing through in results, with 2Q20 showing positive free cash flow despite sales down 53% (positive operating cash flow of $187m in 2Q and positive free cash flow of $90m). Inventory was down in-line with the sales decrease reflecting a clean inventory position heading in to the back half of the year. From the 8/25/20 earnings call:

First of all, the fact that we're selling through at a higher rate than we've ever sold through before sets us up super well from a profitability standpoint as we get in Half 2. That's number one. But secondly, you're also getting a clear signal from customers about, again, just relevant categories, brands and products.

So the combination of the shifted Anniversary sale and meaningful cost cuts could make results look better in the coming quarters. But the long-term benefit from COVID is the competitor closings….

Competitive Closures

COVID has been tough on brick and mortar retail, particularly those who were already in bad shape. Nordstrom has a long history and a strong balance sheet ($1.0bn cash and $1.3bn liquidity as of July 31, 2020) and should persevere while a number of direct department store competitors have filed bankruptcy or closed recently:

Lord & Taylor: August 2020 announced BK and liquidating all 38 stores (LINK)

Barneys: February 2020 liquidated it’s remaining stores (22 stores at peak)

Nieman Marcus: May 2020 filed for bankruptcy and is expected to emerge in fall 2020 (unclear how many of the 69 locations will remain open)

Saks 5th Avenue: Saks has 40 stores and has not closed any but is missing July 2020 rent payments: “In Miami, a luxury-shopping-center landlord began legal proceedings to evict Saks Fifth Avenue two weeks ago for nonpayment of rent amounting to $1.9 million as of early July.” LINK

JC Penney: May 2020 filed bankruptcy, will close 250 of 850 stores LINK

Macy’s: noted on their 9/2/20 earnings call they are closing 97 stores out of 834

Stage Stores: May 2020 filed bankruptcy, will close 738 stores LINK

Stein Mart: August 2020 filed bankruptcy, will close all 280 stores LINK

Further, a number of specialty retailers have declared bankruptcy that are relevant to JWN:

Tailored Brands (JosA Bank and Men’s Warehouse): 500 store closures

Brooks Brothers: 75 stores closures

Ascena (Ann Taylor and other brands): 1600 store closures

New York & Co: 378 closures

J. Crew: 54 store closures

List of other closures: LINK

It is also worth noting that in 2Q20 Nordstrom closed 16 of 116 full line department stores and now has 100 full line department stores mainly in “A” malls plus 248 Rack stores - so JWN is not as over-stored as competitors and “A” malls should be in better shape than lower quality malls. From 10-K filed 3/20/20:

We have a high-quality store portfolio with 95% of our 116 FLS located in “A” malls and most of our 248 Nordstrom Racks in off-mall centers.

And as management noted at a conference on 7/7/20, closing these stores is EBIT accretive with less than a 3% topline impact:

So we made the decision to shut those stores down. It was a very difficult decision, as we talked about. But the top line impact for total JWN is very small. It's less than 3%. We do think -- we have seen in the past the store transfer to other stores in those markets as well as to online, and it's actually EBIT-accretive.

As an example of how powerful it can be to lose competition, see the results from Hibbett Sports (a 1,000 store chain sporting goods retailer) for their July 2020 quarter - comparable store sales were up 79% in the July 2020 quarter (brick and mortar stores up 65% and ecommerce up 212%). As noted in their earnings release:

We believe the increase in traffic into our stores in the second quarter was driven by pent-up demand, temporary closures of competitors and government stimulus payments. A significant portion of this traffic was the result of new customers. We expect to retain many of these customers which will drive sales growth.

Permanent closures of competitors, which we believe is now beginning to take effect, will also drive sales volume and traffic increases as these competitors’ liquidation sales conclude.

While I don’t think JWN will see this kind of benefit, it can be very helpful to lose competition. I think the biggest risk to JWN is share loss as they have grown slower than the winners in their digital and off-price segments, but competitor closures help reduce this risk.

Further, vendors do not want to take credit risk with retailers who are in bad financial shape or don’t present the brand in a positive light. As an example, in August 2020 Nike announced they they are cutting ties with Zappos, Belk, Dillards, Boscov's, Bob's Stores, Fred Meyer, EBLens, VIM, and City Blue with potentially more to come. LINK

This gives an advantage to Nordstrom who has a strong balance sheet and a history of treating partners the right way - JWN will have access to the product shoppers want while competitors close and lose access to product.

Downside Protection

Downside protection is provided by a reasonable valuation, depressed expectations, ~31% insider ownership, and solid balance sheet.

The Nordstrom Family owns ~31% of the equity and has operated conservatively not wanting to take existential risk (JWN was founded in 1901 and has been in the family since):

Bruce Nordstrom, grandson of founder, owns 16.1%

Anne Gittenger, grandaughter of founder, owns 9.9%

Pete Nordstrom, great grandson of founder, President and Chief Brand Officer, owns 2.15% (3.4m shares currently worth $54m)

Erik Nordstrom, great grandson of founder, CEO, owns 2.14% (3.4m shares currently worth $54m)

In March of 2018, the family proposed taking Nordstrom private at $50/share in cash (LINK). The special committee felt this price was too low (2.5 years later the stock is at ~$16).

Again in October 2019 (with the stock in the low-mid $30s) the family had been in discussions about taking their ownership stake above 50% from 31% currently LINK:

Additionally, over the past several months, the Co-Presidents presented the Company’s independent Board members with proposals involving the Company that, if consummated, would have resulted in certain members of the Nordstrom family increasing their beneficial ownership of Company common stock from approximately thirty-one percent to slightly in excess of fifty percent. After due consideration by the Board, these discussions were terminated by the mutual agreement of the Co-Presidents and the independent directors.

So now with the stock in the mid-teens, the Nordstrom family might want to buy more equity which could be a catalyst for the stock.

And on 8/27/20, JWN replaced management’s restricted stock with options with an exercise price of $14.79 which is above the current share price. For example, the CEO replaced 66,786 stock units (worth $1m at $14.50) with 245,829 options with an exercise price of $14.79 (currently out of the money with stock at $14.50) - the stock needs to get to $18.75 for him to breakeven on swapping stock for options (29% upside from here):

Further, the balance sheet is solid. As of July 31, 2020 JWN had $1.0bn of cash and $300m available on a line of credit. JWN has $2,775 of nebt debt and assuming the 2021 estimate for EBITDA of ~1,100 is a normalized run-rate then net debt to ebitda is 2.5x. So the leverage is something to watch, but with the family’s ownership stake I think they would avoid taking any existential risk, JWN should be cash flow positive going forward (and was cash flow positive in 2Q20 even with sales down 53%), and the majority of long-term debt is due in 2027 or beyond with some maturities out to 2044 (from 10-K filed 3/20/20 below):

In 2Q20, cash interest expense was $34m, cash taxes of $8m , and capex of $97m. Using these as a run rate gets to annual cash interest of $136m, taxes of $32m, and capex of $400m. Subtracting this from the $1,080 EBITDA estimate gets to ~$500m of FCF or a ~20% FCFE yield.

(Note: Rent expense was $116m in the first half of 2020, though is likely going lower with 19 store closures, so annual rent expense is probably in the low $200m range.)

Further, JWN owns the land below 33 of it’s full line stores which may have some equity value:

Valuation

Over the past 3 years JWN has traded at 5.0x to 7.5x forward EBITDA. Looking at 2021 (a more normalized year), the consensus EBITDA estimate is $1,080m which is 22% lower than the actual EBITDA the company earned in 2019. Given the dynamic landscape it is impossible to have certainty looking to the future, but the estimates do not seem overly optimistic given the company will have implemented $500m of annual cash savings by the end of 2020, (so nearly half of the 2021 EBITDA estimate will be accomplished through cost savings).

If we go back to the guidance JWN provided on March 3, 2020 (right at the onset of COVID), management had guided to $815-855m of EBIT for 2020, and adding back $670m of D&A implies management thought they could do $1,485 to $1,525m of EBITDA in 2020 prior to COVID. Further, the 4/7/20 proxy shows that management’s incentive comp was weighted to Target EBIT in 2019 of $977m which implies a 2019 incentive target of $1,650 of EBITDA (Pete and Erik Nordstrom had 100% of their incentive comp weighted to this target, and an ROIC threshold must be hit before the EBIT target can be paid out).

So in that context, the $1,080 estimate for 2021 is substantially lower than prior results and prior guidance.

Applying a 5x EBITDA multiple (low end of historical valuation range) to the 2021 estimate f $1,080 gets to $17, slightly above where the stock is now.

If at some point in the future, JWN gets back to doing the EBITDA they accomplished in 2019, a 5x multiple is ~$26.

If at some point in the future, JWN gets to their initial 2020 guidance, a 5x multiple is $30+.

With the cost cuts and competitor closures, it seems possible that JWN could get back to 2019 levels or beyond in a post-COVID environment. It also seems possible that the multiple could go above the 5x low if the market believes JWN will be a survivor, if the family adds to their stake, if the balance sheet improves through cash flow generation, etc. So a multiple around the middle or high end of JWN’s historical range would provide a lot of upside. If we wanted to get crazy and apply a 7x EBITDA multiple on the initial 2020 guidance, the stock would be ~$50 and up over 3x from current prices.

I believe there is also an argument to be made that companies who weathered the extreme stress-test of COVID will deserve a higher multiple in the future as their business has proved resilient.

Further detail on JWN’s 3/3/20 guidance is below. Of course the world has changed a lot since this guidance was provided, but I think it provides some guidepost to what could be possible in the future and maybe why management is personally taking more equity exposure:

Management had been planning on $3.25 to $3.50 in EPS in 2020. Over the past 3 years, JWN has traded at 8 to 17x forward EPS. Applying 8x on this guidance is $27/share.

Management had also guided to Free Cash Flow of $772m, or ~$5/share and 10x FCF is ~$50. As noted in the 3/3/20 earnings release:

The Company completed its generational investment cycle with the opening of its NYC flagship store in 2019. Fiscal 2020 is a pivotal point in free cash flow inflection.

JWN had also guided to $300 to $400m of share buy backs in 2020.

And worth noting that JWN paid $1.46 per share in dividends in 2019, which is a ~9% yield on the current stock price (though the dividend has been halted in the current environment).

Other Points:

Digital sales were 33% of sales in F2019 which implies $5bn of digital sales in f19, $1bn of which are off price

Full price is 2/3 of sales: 40% of which is digital and 100 full line stores

Off Price is 1/3 of sales: 20% of which is digital and 248 Rack stores

“A little less than 40% of the business was done in 2019 in a mall. Clearly, it's going to be less than that in 2020 as well.” -CEO 7/7/20

Digital sales spiked to 61% of sales in 2Q20 (Note: Digital sales are online sales and digitally assisted store sales which include Online Order Pickup, Ship to Store, Style Board, a digital selling tool, and the impact of the sales return reserve.)

JWN is utilizing stores to fulfill online orders and make the stores more productive – May 2020 press release:

More than half of Nordstrom.com orders are currently fulfilled from full-line stores, and 25 percent of Nordstromrack.com and HauteLook.com orders are now fulfilled by Nordstrom Rack stores. Nordstrom recently launched its dedicated e-commerce site to serve customers in Canada, with all online sales fulfilled from the six full-line stores there.

CEO 9/10/20: “We tested -- and when the pandemic hit, having a bit of a heck of a solution of providing store fulfill capabilities for rack.com and HauteLook. And we've had that in Full-Price for a number of years. We haven't had that in Off-Price. That will launch in October. And the result of that is a significant increase in selection that we will have online by bringing to life that inventory we have in our stores.”

JWN will be hosting a virtual investor event later this year. This is usually a good sign that management has something positive to talk about and JWN has not hosted an event since March 2018:

“We look forward to providing additional details on our growth strategy at our virtual investor event later this year.” - CEO 8/25/20

13m loyal customers through the Nordy Club Loyalty program and private label credit card:

We now have 13 million customers in The Nordy Club who contributed 2/3 of our sales in 2019. - CFO 3/3/20

Management has been working on a transition plan since 2019 - Wall Street may like to see new management given weak execution LINK

In September 2020, JWN hired a new men’s director LINK

Macy noted luxury as strong on their 9/9/20 presentation at the GS conference which is positive for JWN:

“Across both digital and stores in both Bloomingdale's and Macy's, luxury is also outpacing our expectations. From textiles to shoes to handbags, to mattresses to diamonds to luxury beauty and fragrances, luxury has proved to be strong across almost every category of business. For instance, at Bloomingdale's, luxury represented 30% of the Q2 2020 business compared to 20% in Q2 of 2019 and is trending 23 points better than the total company trend.”

“Luxury has obviously emerged quickly.”

RH noted on their 9/9/20 earnings call that August and September trends have accelerated (this is a similar high-end customer to JWN)

“While we are not providing detailed financial guidance given the uncertainties in the overall market, our business trends have continued to build month over month with RH Core demand +7% in May, +32% in June, +34% in July, and +47% in August versus the same months a year ago. Our September to date numbers are showing continued strength, +44% in the first 10 days of the fiscal month.”

On 9/11/20, Crocs pre-announced 3Q20 sales +10% vs guidance from 7/30/20 of flat for 2H20 (JWN sales are 24% shoes):

“We have experienced exceptional consumer demand and strong sell throughs. As a result, we expect revenue growth of approximately 10% in the third quarter and anticipate our business continuing to strengthen.” - CROX CEO 9/11/20

H&M 9/15/20: Sales June-August 2020 down 16%, better than down 30% June 1-13th, and down 50% in March to May

Upcoming vaccine will help as customers feel comfortable shopping again and have more occasions to go out

Macy’s noted on 9/9/20 an improvement in 3Q20 in COVID areas: “The 12 states where we've seen COVID resurgence hotspots have improved since July, and these states include Florida, Texas, Arizona and California.”

NYC is opening for indoor dining September 30th which means more occasions to go out and could help JWN’s NYC location LINK

Private label is 10% of sales: “Our private label business makes up around 10% of sales, with less than 30% sourced from China.”

Short interest is 26% of float and has been climbing:

Strong stock market helps the JWN customer

Management leads by example and declined salary from April to September:

“The Nordstrom Executive Leadership Group will forgo a part of their salary, and both Pete and Erik Nordstrom will decline their salary from April through September. Similarly, all members of the Company’s Board of Directors will forgo cash compensation for a six-month period.”

Catalysts

Improving sales, earnings, cash flow, and balance sheet

Upcoming Investor Day

Management now more incentivized to get stock higher

Vaccine

New management

Family adding to ownership stake or revisiting take-private transaction

Re-instating dividend or share buy-back

Risk

Nordstrom may be a share loser: Nordstrom’s off-price business has not grown as fast as TJX or ROST, Nordstrom’s digital business has not grown as fast as other online competitors, and the full-price department store business is tough

Brick and mortar retail is difficult, and Nordstrom is exposed to mall traffic though roughly 1/3 of revenue comes from the mall and JWN’s 100 department stores are located at “A” malls

Amazon launching a luxury platform – article from 9/15/20

NYC store opened in Fall 2020 - not great timing to open a large expensive store in Manhattan given COVID

Trend toward “casualization” of America

Tourism - lack of tourism due to COVID likely hurts

Multiple compression based on declining sales and earnings

Leveraged balance sheet

Credit rating downgrade

Corporate tax rate going up from 21%

Every other risk that goes with the over-stored and extremely competitive nature of retail

If you have any insights, please reach out on twitter: @RationalResear

DISCLAIMER: Nothing here is investment advice. This is for informational purposes only. Do your own research.

“In 2Q20, cash interest expense was $34m, cash taxes of $8m , and capex of $97m. Using these as a run rate gets to annual cash interest of $136m, taxes of $32m, and capex of $400m. Subtracting this from the $1,080 EBITDA estimate gets to ~$500m of FCF or a ~20% FCFE yield.”

I’m still learning so apologies for the elementary questions, but why aren’t you including rent expenses in the calculation above?

Your analysis mirrors mine almost exactly, and it's lonely out here!

I would only emphasize what you have already noted - that reduction of in-line mall locations of competitors/vendors is an often overlooked incremental benefit to Nordstrom, as well as the fact that, even though Nordstrom is located predominantly in A malls, it is not necessary to enter the mall to shop at Nordstrom, and having visited myself several times recently, visiting Nordstrom, even during these challenging times, is a very comfortable experience.....