Housing

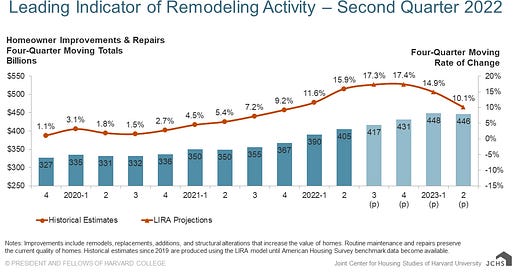

Leading Indicator of Remodeling Activity

The LIRA projects year-over-year gains in remodeling expenditures to owner-occupied homes will decelerate from 17.4 percent in 2022 to 10.1 percent by the second quarter of 2023.

NAHB Builders Confidence Index

Builder confidence plunged in July as high inflation and increased interest rates stalled the housing market by dramatically slowing sales and buyer traffic. In a further sign of a weakening housing market, builder confidence in the market for newly built single-family homes posted its seventh straight monthly decline in July, falling 12 points to 55, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This marks the lowest HMI reading since May 2020 and the largest single-month drop in the history of the HMI, except for the 42-point drop in April 2020.

Lumber

Single Family Housing Starts

ReMax

• June posted the most home sales of any month thus far this year, topping May by 4.7% but falling 17.6% short of June 2021.

• Inventory grew for a third consecutive month by a whopping 34.1% over May and 27.5% year over year.

• While up 11% year over year, the Median Sales Price of $428,000 inched just 0.6% above May’s.

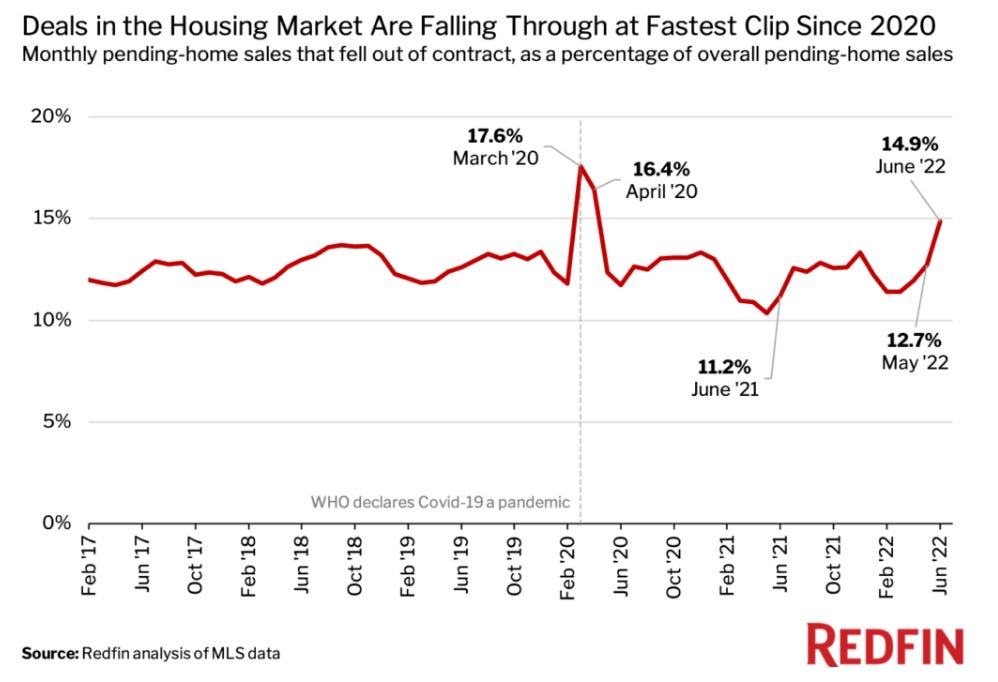

Redfin

The median home sale price was up 11% year over year to $389,200. This was down 1.7% from the peak during the four-week period ending June 19. A year ago the median price rose 0.9% during the same period. The year-over-year growth rate was down from the March peak of 16%.

The median asking price of newly listed homes increased 14% year over year to $396,448, but was down 2.8% from the all-time high set during the four-week period ending May 22. Last year during the same period median prices were down just 0.8%.

The monthly mortgage payment on the median asking price home hit $2,389 at the current 5.54% mortgage rate, up 45% from $1,650 a year earlier, when mortgage rates were 2.78%. That’s down slightly from the peak of $2,486 reached during the four weeks ending June 12.

Pending home sales were down 15% year over year, the largest decline since May 2020.

New listings of homes for sale were down 3% from a year earlier.

Active listings (the number of homes listed for sale at any point during the period) rose 3% year over year—the largest increase since August 2019.

Rent increases tapered off in June, with the national median asking rent rising 14% from a year earlier—the smallest annual increase since October, according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage.

Asking rents were up 0.7% from May, the smallest month-over-month gain since the start of the year.

Pool Corp

Second, following 2 years of very favorable weather in the second quarter, we experienced a cooler and wetter start this year in our seasonal markets that delayed many projects impacted the demand and timing of sales of many products from packaged pools and equipment to chemicals. As we would have expected, when the weather improved later in the quarter, sales for these products increased to fulfill the strong demand.

Our sales growth expectations for the year remain consistent with the net sales guidance range of 17% to 19% we discussed on our February call. Additional vendor price increases in second quarter, not factored into our previous guidance are offset by slit decreases in volume as a portion of the business related to consumables was impacted by negative weather in Q2.

also when we get to Q4, the overall expectation for inflation for the year at 10% to 11% will be less in the fourth quarter because we'll be lapping some of those costs that were already embedded in the prior year numbers for fourth quarter.

Consumer

JP Morgan

Spend is still healthy with combined debit and credit spend up 15% year-on-year. We see the impact of inflation and higher nondiscretionary spend across income segments. Notably, the average consumer is spending 35% more year-on-year on gas and approximately 6% more on recurring bills and other nondiscretionary categories. At the same time, we have yet to observe a pullback in discretionary spending, including in the lower income segments, with travel and dining growing a robust 34% year-on-year overall.

And with spending growing faster than incomes, median deposit balances are down across income segments for the first time since the pandemic started, though cash buffers still remain elevated. With that as a backdrop, this quarter, CCB reported net income of $3.1 billion on revenue of $12.6 billion, which was down 1% year-on-year.

Citigroup

Higher rates and QT will keep volatility high. That said, while sentiment has shifted, little of the data I see tells me the U.S. is on the cusp of a recession. Consumer spending remains well above pre-COVID levels with household savings providing a cushion for future stress. And as any employer will tell you, the job market remains very tight.

Similarly, our corporate clients see robust demand and healthy balance sheet with revenue softness attributed to supply chain constraints so far. So while a recession could indeed take place over the next 2 years in the U.S., it's highly unlikely to be a sharper downturn as others in recent memory.

I'm just back from Europe, where it's a different story. We expect a very difficult winter is coming, and that's due to disruptions in the energy supply. There is also increasing concern about second order effects on industrial production and how that will affect economic activity across the continent. And the mood is, of course, further darkened by the belief that the war in Ukraine will not end anytime soon.

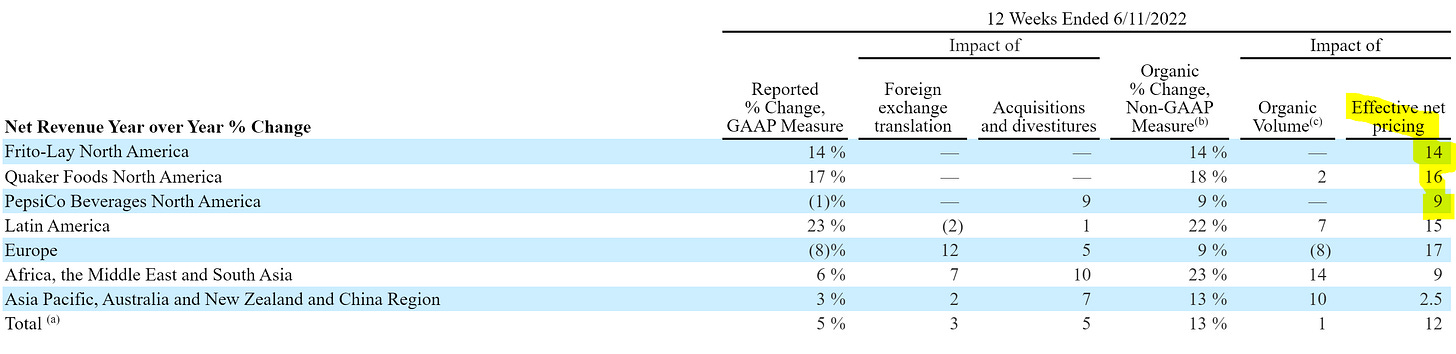

Pepsi

Tractor Supply

Comparable store sales increased 5.5%, as compared to an increase of 10.5% in the prior year's second quarter. Comparable store sales for the second quarter of 2022 were driven by comparable average ticket growth of 7.5%, offset by a decrease in comparable average transaction count of 2.0%. Comparable store sales growth reflects continued strength in every day, needs-based merchandise, including consumable, usable and edible (“C.U.E.”) products and year-round product categories.

As you model the second half of the year, let me address 2 items. First, for both the third and fourth quarters, we would anticipate that our comp sales growth would be consistent with our first half of the year. As Hal mentioned earlier, the extreme heat and drought conditions are continuing into the third quarter, and we forecast these conditions will limit upside to sales.

For the second half of the year, we expect inflation to be consistent at an elevated level. With as much inflation pressure we are seeing in our business, we continue to closely watch comparable average ticket and transactions. In times of rising inflation, we anticipate that the breakdown of comp sales growth will trend to higher ticket performance from inflation, offset by transactions. The impact on transactions is pronounced this year, especially as we lap the prior year's benefit from stimulus.

AT&T

And on the consumer side of our business, we're seeing an increase in bad debt to slightly higher than pre-pandemic levels as well as extended cash collection cycles. However, it's important to note that historical patterns in previous economic cycles suggest customers have managed their accounts similar to what we're experiencing today.

So in terms of DSOs, here's what we know. This is a trend that is relatively nascent. It is probably 6 weeks or so that we start to see an uptick in days sales outstanding. Is it a trend? Is it going to get worse? We don't know, but here's what we do know. We do know that, as John alluded to, in prior recessions, customers may have paid late but they paid us. So there's nothing to suggest given the mission-critical nature of our services that customers won't pay us because they're going to want to maintain connectivity. So in that regard, we think it is a timing issue. And I think in this macro environment, I'm not going to call whether it's going to get much, much worse than where we are today. But we're taking a prudent view and not assuming it's going to get better, given all the uncertainty.

Tech

Service Now

During a TV appearance on CNBC late Monday, McDermott spoke cautiously about larger economic issues such as increases in interest rates, the strength of the U.S. dollar, rising energy costs and the ongoing war between Ukraine and Russia. McDermott suggested that confluence of such factors is causing some customers to re-consider spending priorities and look more at products that deliver a faster return on their investments.

SNAP

We're seeing these various headwinds put pressure on the earnings of a wide variety of companies, and this is directly impacting the demand for advertising. Specifically, the advertising spending, in particular, auction-driven direct response advertising is among the very few line items in a company's cost structure that they can reduce immediately in response to pressure on their top line or their input costs. As a result, as many industries and verticals have come under top line or input cost pressure, advertising spending has been amongst the first areas impacted.

And to put a finer point on that, we've, over time, worked very hard to make it very easy for our clients to turn on advertising and to ramp their advertising. And that's been particularly good for our business as budgets have grown over time. But in a period where we're seeing headwinds, it's also very easy to turn off and very quick to turn off. So we see this dynamic within our business as advertisers have lowered their budgets and their bids per action to reflect their current willingness to pay.

Seagate

Let us now turn to the current market environment. Despite the ongoing impacts of COVID lockdowns and supply challenges, mass capacity revenue was flat quarter-over-quarter, due in part the strong cloud customer adoption of our 20-plus terabyte nearline drives. U.S. cloud data center demand remains strong. However, persistent non-HDD component shortages have led to inventory imbalances, precluding new data center build-outs from being completed.

These, along with other supply disruptions have led to a buildup in inventory levels across a broad spectrum of customers, a trend that continued through the end of the quarter. As macro uncertainties and inflationary pressures intensify, we expect customers will increasingly focus on reducing their inventory levels while maintaining the ability to address end market demand.

Within the legacy market, revenue was $489 million, down 24% sequentially and 43% year-over-year. The decline was most pronounced in the client PC end market, which now represents a mid-single-digit percentage of our overall revenue. Consumer demand also deteriorated more than anticipated, reflecting the sharp rise in inflation impacting consumer discretionary spending.

Odds and Ends

Robert Half - RHI: Before we move to third quarter guidance, let's review some of the monthly trends we saw in the second quarter and so far in July, all adjusted for currency and billing days. Contract talent solutions exited the second quarter with June revenues up 18% versus the prior year compared to a 21% increase for the full quarter. Revenues for the first week of July were up 16% compared to the same period 1 year ago. Permanent placement revenues in June were up 38% versus June of 2021. This compares to a 43% increase for the full quarter. For the first 2 weeks of July, permanent placement revenues were up 3% compared to the same period in 2021. This period includes the historically variable impact of the Fourth of July holiday. We provide this information so that you have insight into some of the trends we saw during the second quarter and into July. But as you know, these are very brief periods of time. We caution against reading too much into them.

The major financial assumptions underlying the midpoint of these assumptions are as follows: revenue growth on a year-over-year basis; talent solutions up 16% to 19%; Protiviti up 6% to 9%; overall up 12% to 16%; gross margin percentage, contract talent, 38% to 40%; Protiviti, 28% to 30%; overall, 42% to 44%.

US Federal Reserve Balance Sheet